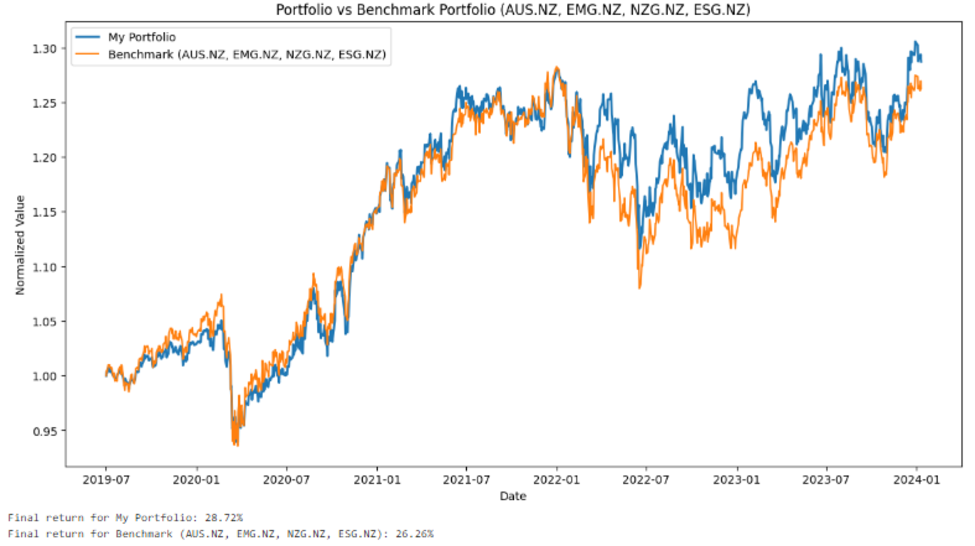

EXAMPLE...OUR NZ PASSIVE PORTFOLIO:

8.00% in Emerging Markets Equities

Holder of companies´ shares from countries such as South Korea, China, Mexico and Brazil.

Selected asset: NZX´s Smartshares Emerging Markets Equities ESG ETF (EMG).

Rationale: Low fee (0.59% per year) NZX´s ETF that is designed to track the return on the MSCI EM IMI ESG Screened Index.

Selected asset: NZX´s Smartshares Emerging Markets Equities ESG ETF (EMG).

Rationale: Low fee (0.59% per year) NZX´s ETF that is designed to track the return on the MSCI EM IMI ESG Screened Index.

31.00% in Australian Equities

Shareholder of 200 companies from Australia.

Selected asset: NZX´s Smartshares S&P/ASX 200 ETF (AUS).

Rationale: Low fee (0.30% per year) NZX´s ETF that is designed to track the return on the S&P/ASX 200 Index (in NZD).

Selected asset: NZX´s Smartshares S&P/ASX 200 ETF (AUS).

Rationale: Low fee (0.30% per year) NZX´s ETF that is designed to track the return on the S&P/ASX 200 Index (in NZD).

42.00% in Developed Markets Equities

Holder of companies´ shares from countries such as United States, Japan, UK, Germany, etc.

Selected asset: Investnow´s Vanguard International Shares Select Exclusions Index Fund.

Justification: Low fee (0.20% per year) Vanguard´s fund that is designed to track the return of the MSCI World ex Australia, ex Tobacco, ex Controversial Weapons, ex Nuclear Weapons (with net dividends reinvested).

Selected asset: Investnow´s Vanguard International Shares Select Exclusions Index Fund.

Justification: Low fee (0.20% per year) Vanguard´s fund that is designed to track the return of the MSCI World ex Australia, ex Tobacco, ex Controversial Weapons, ex Nuclear Weapons (with net dividends reinvested).

14.00% in New Zealand Equities

Shareholder of 50 companies in New Zealand.

Selected asset: NZX´s Smartshares S&P/NZX 50 ETF (NZG) and Harbour NZ Index Shares Fund

Justification: Low fee (0.20% per year) ETF (or passive fund) that is designed to track the return on the S&P/NZX 50 Index (or S&P/NZX Portfolio Index)

Selected asset: NZX´s Smartshares S&P/NZX 50 ETF (NZG) and Harbour NZ Index Shares Fund

Justification: Low fee (0.20% per year) ETF (or passive fund) that is designed to track the return on the S&P/NZX 50 Index (or S&P/NZX Portfolio Index)