WHY PASSIVE INVESTING?

"IF YOU CAN'T BEAT IT, JOIN IT"

In the long run, very few investors are able to consistently "beat the market", with low risk.

- Studies show that in more than 80% of cases, active investment strategies - such as stock picking, day trading and timing the market - lose to "the average market" in the long run (5+ years).

"INVESTING SHOULD BE AS BORING AS WATCHING THE GRASS TO GROW"

Do not waste your time reading reports and balance sheets aiming to find "the next Tesla": it is the time in the market and the regular contributions that will buy you "free time in the future".

- Dedicate your hours to your current source of income (or even to develop new ones), but put your savings (and time) to work for you!

3 STEPS TO IMPLEMENT THE PASSIVE STRATEGY:

Step 1: Objectives, profile and portfolio

Define your investment goals (ex: 10% return per year) and build a portfolio with assets that have the capacity to achieve these goals but that also fits your profile as an investor (conservative, moderate, aggressive, etc.).

Step 2: Stay invested

Contribute periodically to your portfolio (and re-balance whenever needed), using the broker of your choice.

Step 3: Time and opportunities

Do not panic about crises or negative news: take advantage of opportunities and market conditions/cycles.

Let the time (ie. compound interest!) to act, protecting and monetizing your capital in the long run.

Let the time (ie. compound interest!) to act, protecting and monetizing your capital in the long run.

STEP 1: Profile, Goals and Portfolio

Step 1.1: Investor Profile

Identify (or validate) your investor profile.

There are basically 3 investor profiles:

-Conservative,

-Moderate,

-Aggressive.

In fact, each profile reflects the following:

- A certain return expectation (the more conservative, the lower the return expectation)

- A certain exposure to risk (the more conservative, the lower the "appetite" for risk)

- A given portfolio: the constituent asset classes, the assets themselves, the allocation in each one of them and the correlation between the asset classes.

There are basically 3 investor profiles:

-Conservative,

-Moderate,

-Aggressive.

In fact, each profile reflects the following:

- A certain return expectation (the more conservative, the lower the return expectation)

- A certain exposure to risk (the more conservative, the lower the "appetite" for risk)

- A given portfolio: the constituent asset classes, the assets themselves, the allocation in each one of them and the correlation between the asset classes.

Step 1.2: Investment Objectives

Define your investment goals.

In other words, what is the purpose of your investments?

-Preserving your capital?

-Protect yourself from inflation?

-Protect yourself against the devaluation of the currency?

-Have an extra income?

-Monetize your capital?

Define your investment goal (aligned with your investor profile and investment objectives).

Example: In the long run, to achieve an average return of 10% per year.

In other words, what is the purpose of your investments?

-Preserving your capital?

-Protect yourself from inflation?

-Protect yourself against the devaluation of the currency?

-Have an extra income?

-Monetize your capital?

Define your investment goal (aligned with your investor profile and investment objectives).

Example: In the long run, to achieve an average return of 10% per year.

Step 1.3: Build your passive portfolio

Build a passive investment portfolio that has the capacity to achieve these goals and objectives but that also suits your profile as an investor.

Consider which asset classes (and the actual assets in each one of them) to build a passive, balanced and diversified portfolio.

Example: International equity ETFs traded on NZX tend to monetize your capital just as they tend to protect against the devaluation of the local currency.

Another example: fixed income financial assets tend to preserve your capital and some of them tend to protect you against inflation.

Consider the expectations for return and volatility (ie. risk) of the asset classes and the assets themselves.

Example: Historically, NZX's ETFs that follow the S&P 500 had an average return of 13% per year, but remember that past returns are no guarantee of future returns.

Consider correlations between asset classes seeking to allocate to poorly (or uncorrelated) asset classes.

Consider which asset classes (and the actual assets in each one of them) to build a passive, balanced and diversified portfolio.

Example: International equity ETFs traded on NZX tend to monetize your capital just as they tend to protect against the devaluation of the local currency.

Another example: fixed income financial assets tend to preserve your capital and some of them tend to protect you against inflation.

Consider the expectations for return and volatility (ie. risk) of the asset classes and the assets themselves.

Example: Historically, NZX's ETFs that follow the S&P 500 had an average return of 13% per year, but remember that past returns are no guarantee of future returns.

Consider correlations between asset classes seeking to allocate to poorly (or uncorrelated) asset classes.

STEP 2: STAY INVESTED

STEP 2.1: PERIODIC CONTRIBUTIONS

Put regular contributions on your passive portfolio, using the broker of your choice.

The final result of your investment is directly proportional to the amount and frequency of your contributions.

The final result of your investment is directly proportional to the amount and frequency of your contributions.

- The greater your contribution, the greater your final balance in the long term.

- The more frequent your contributions, the greater your final balance in the long term.

STEP 2.2: REBALANCE

Rebalance your portfolio whenever appropriate.

Rebalancing means making purchases (and sales) of assets in order to get back to the desired allocation percentages.

Be careful not to make unnecessary movements as they tend to generate unnecessary costs and taxes.

You may use the regular contributions to buy more of the assets that performed the least in your portfolio.

In other words, buy the asset(s) with the lowest current balance (or the largest deviation from the desired allocation).

Rebalancing means making purchases (and sales) of assets in order to get back to the desired allocation percentages.

Be careful not to make unnecessary movements as they tend to generate unnecessary costs and taxes.

You may use the regular contributions to buy more of the assets that performed the least in your portfolio.

In other words, buy the asset(s) with the lowest current balance (or the largest deviation from the desired allocation).

STEP 3: TIME AND OPPORTUNITIES

STEP 3.1: WAIT FOR TIME AND COMPOUND INTEREST TO ACT

Wait for the time and the compound interest to act on your investments.

From the Future Value formula*, we know that time is the only variable that exponentially impacts the final balance of your investment.

*Future Value = (Initial amount * (1 + rate) ^ time) + (contributions * [ (1+ rate)^ time -1] / rate)

From the Future Value formula*, we know that time is the only variable that exponentially impacts the final balance of your investment.

*Future Value = (Initial amount * (1 + rate) ^ time) + (contributions * [ (1+ rate)^ time -1] / rate)

STEP 3.2: SEIZE THE OPPORTUNITIES

Take advantage of opportunities and market conditions (cycles!).

Don't panic over crises or negative news. The long-term investor should pay no attention to them. It would be interesting to do exactly the opposite: buy more when prices fall.

Be aware of changes in market conditions. Know the asset class cycles and use them for your benefit.

Don't panic over crises or negative news. The long-term investor should pay no attention to them. It would be interesting to do exactly the opposite: buy more when prices fall.

Be aware of changes in market conditions. Know the asset class cycles and use them for your benefit.

IS THIS ALL?

EXAMPLE: A SIMPLE NZ-BASED PASSIVE PORTFOLIO, WITH ONLY 4 ETFs:

25% in New Zealand Equities

Invest in the local New Zealand listed companies.

Examples of possible assets: Smart S&P/NZX 50 ETF (NZG) or Smart NZ TOP 50 ETF (FNZ).

Examples of possible assets: Smart S&P/NZX 50 ETF (NZG) or Smart NZ TOP 50 ETF (FNZ).

25% in Australian Equities

Invest in Australian listed companies.

Examples of possible assets: Smart Australian Top 200 ETF (AUS) or Smart AUS TOP 20 ETF (OZY).

Examples of possible assets: Smart Australian Top 200 ETF (AUS) or Smart AUS TOP 20 ETF (OZY).

25% in Developed Markets Equities

Invest in listed companies from developed markets: US, Europe, Japan, etc

Examples of possible assets: Vanguard International Shares Select Exclusions Index Fund, Smart Global ESG ETF (ESG), Smart US Equities ESG ETF (USA) or Smart US 500 ETF (USF).

Examples of possible assets: Vanguard International Shares Select Exclusions Index Fund, Smart Global ESG ETF (ESG), Smart US Equities ESG ETF (USA) or Smart US 500 ETF (USF).

25% in Emerging Markets Equities

Invest in listed companies from Emerging Markets: China, South Korea, Russia, Mexico, etc

Examples of possible assets: Smart Emerging Markets Equities ESG ETF (EMG) or Smart Emerging Markets ETF (EMF).

Examples of possible assets: Smart Emerging Markets Equities ESG ETF (EMG) or Smart Emerging Markets ETF (EMF).

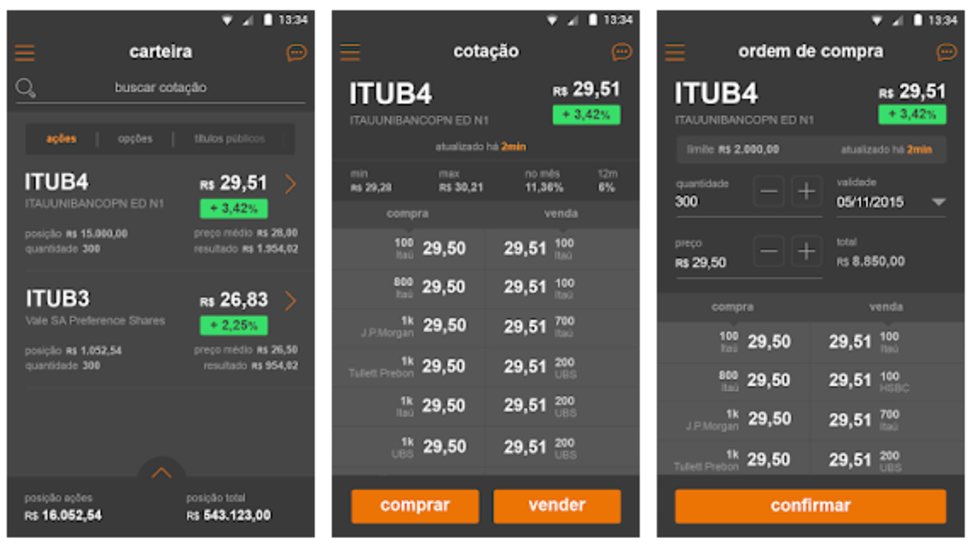

HOW TO PUT A "BUY" ORDER IN THE BROKER (example: Investnow)

Find the financial asset

- You should look for the financial asset, such as Smartshares S&P ASX 200 (AUS). Please do not consider the images here.

- Once this is done, click on the "Invest" button (or the sell button, if this is your choice).

Set the amount

- Enter the amount you want to invest in that specific asset. In case of a sale, inform the quantity of shares you want to sell.

Confirm your order

- Check the information and if everything is right, confirm the placement of your order. It will be processed later on by the broker.