3 STEPS TO IMPLEMENT THE PASSIVE STRATEGY:

Step 1: Objectives, profile and portfolio

Define your investment goals (ex: 10% return per year) and build a portfolio with assets that have the capacity to achieve these goals but that also fits your profile as an investor (conservative, moderate, aggressive, etc.).

Step 2: Stay invested

Contribute periodically to your portfolio (and re-balance whenever needed), using the broker of your choice.

Step 3: Time and opportunities

Do not panic about crises or negative news: take advantage of opportunities and market conditions/cycles.

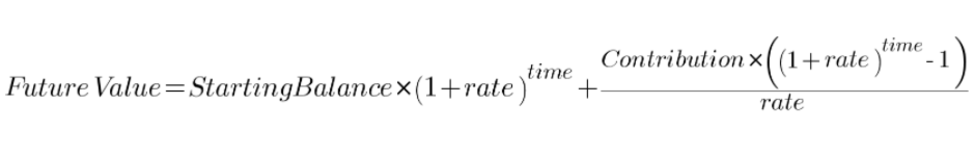

Let the time (ie. compound interest!) to act, protecting and monetizing your capital in the long run.

Let the time (ie. compound interest!) to act, protecting and monetizing your capital in the long run.